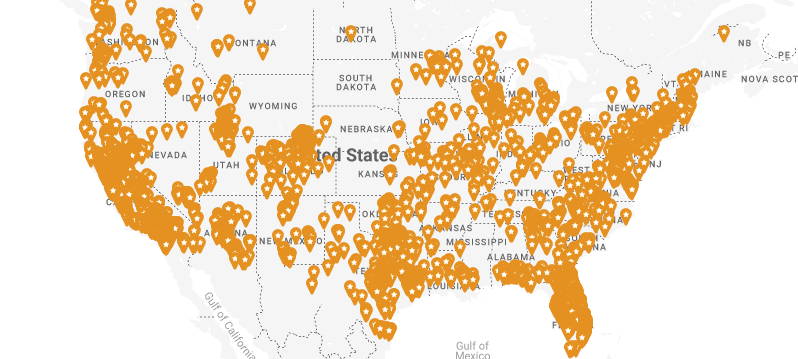

As a company that specializes in low cost solar, we understand the importance of making renewable energy sources accessible and affordable to everyone.

The Federal Solar Investment Tax Credit (ITC) is a great resource for homeowners to save money while helping the environment.

The ITC offers a 30% credit on the total cost of a solar panel installation, including qualified battery storage and any additional necessary equipment.

In 2022, the Inflation Reduction Act extended this credit until 2034, and edited the language surrounding a “Qualified Battery Storage Technology Expenditure” to specify the following stipulations:

‘‘(A) is installed in connection with a dwelling unit located in the United States and used as a residence by the taxpayer, and

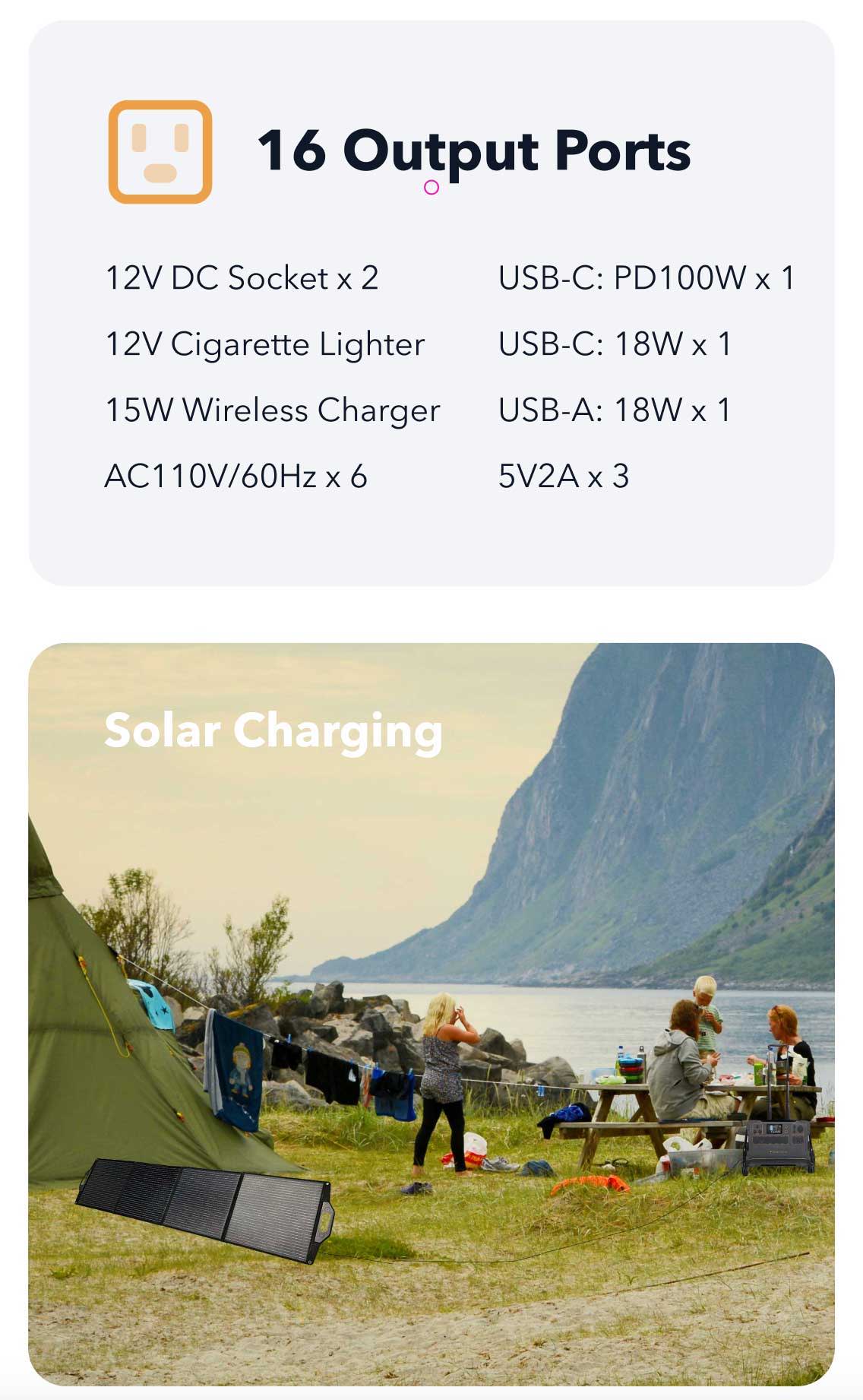

‘(B) has a capacity of not less than 3,000 Wh’’

This means that batteries must be installed in connection with your home and have a capacity of 3kWh or greater–however, this also means that standalone batteries are eligible.

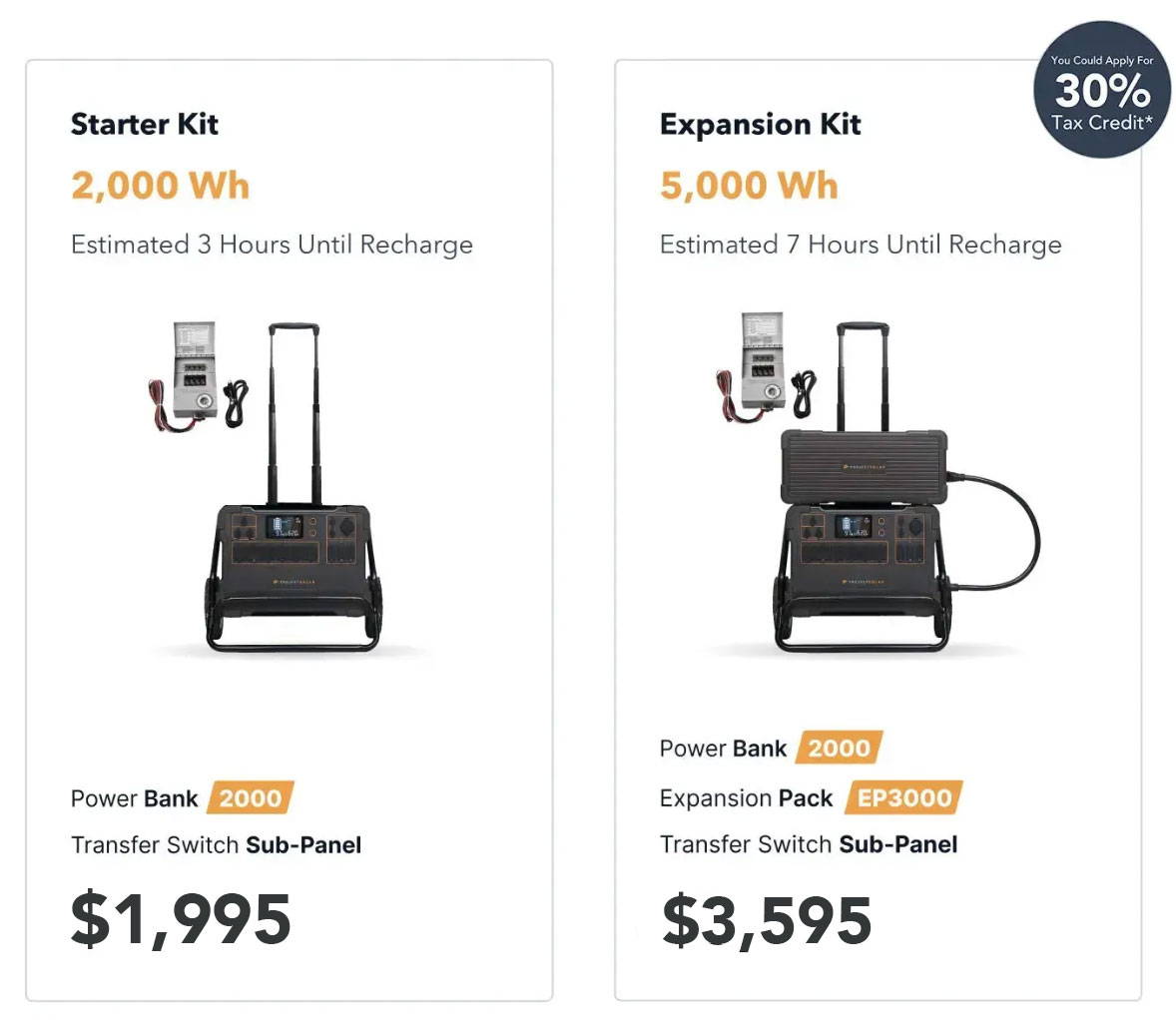

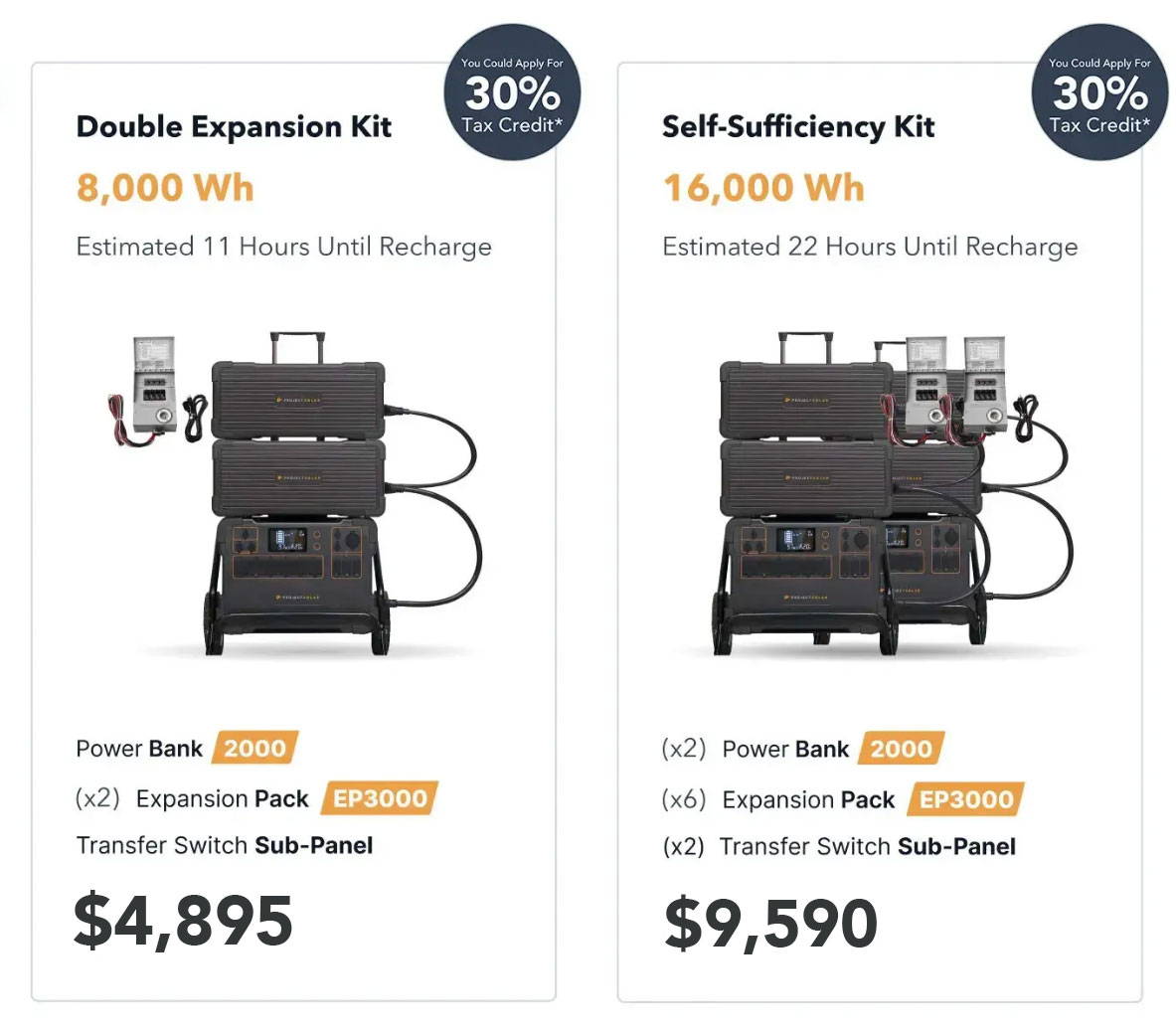

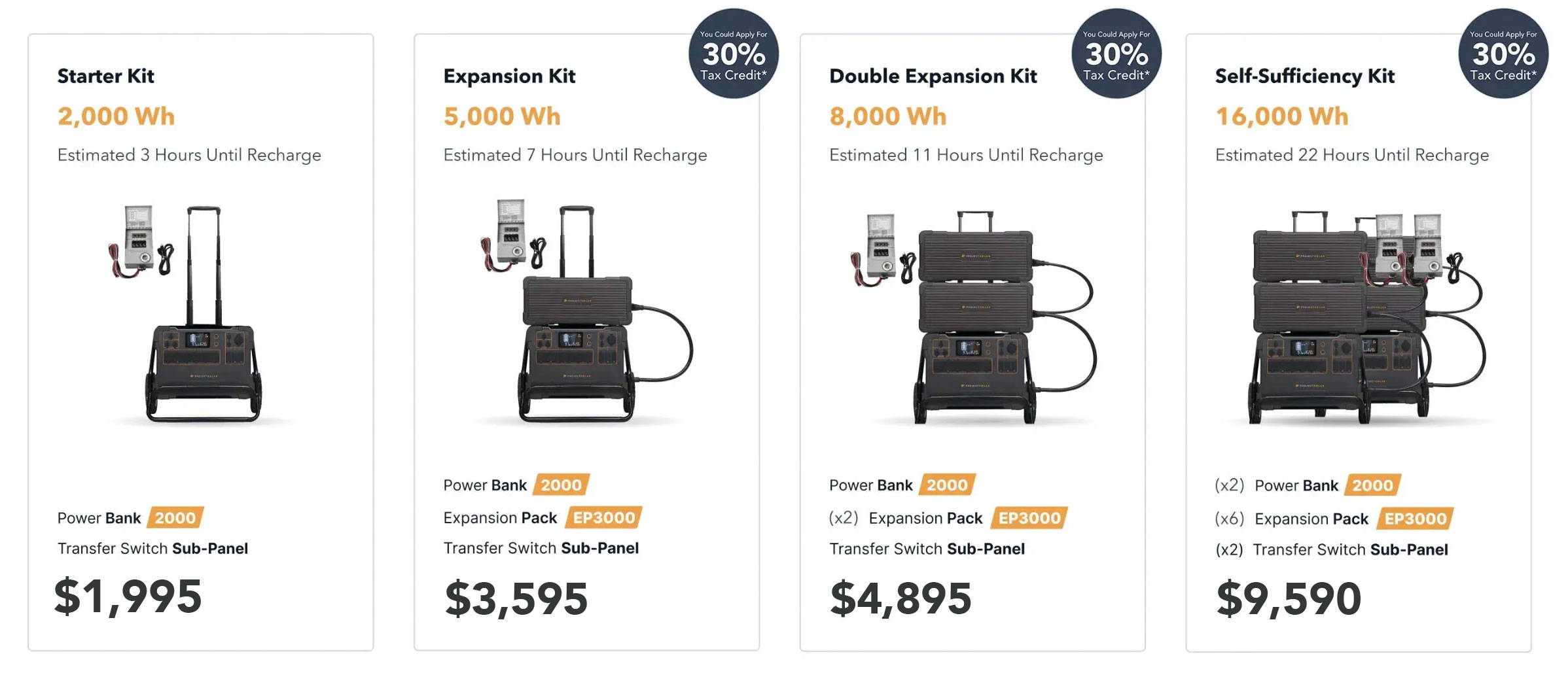

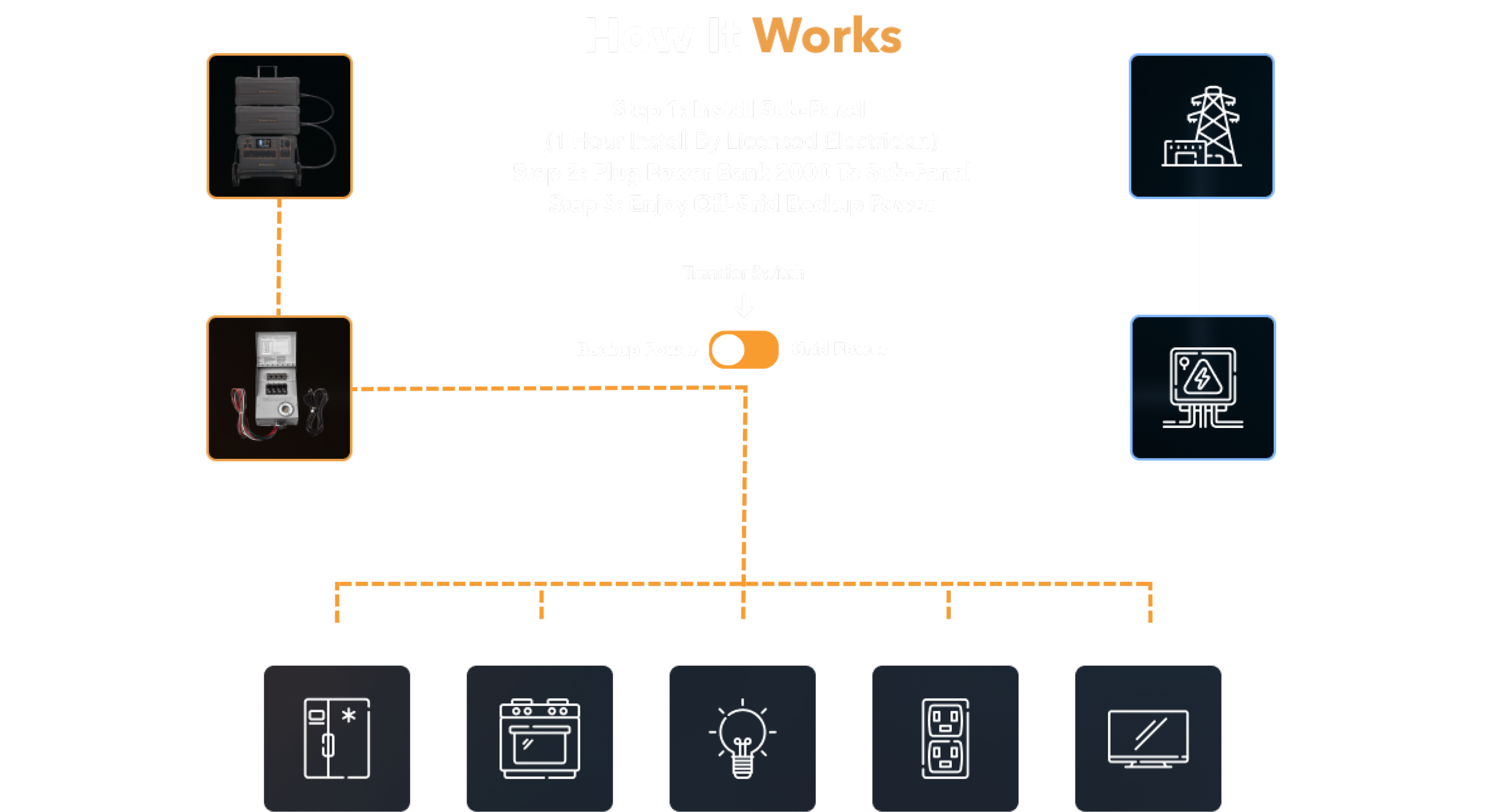

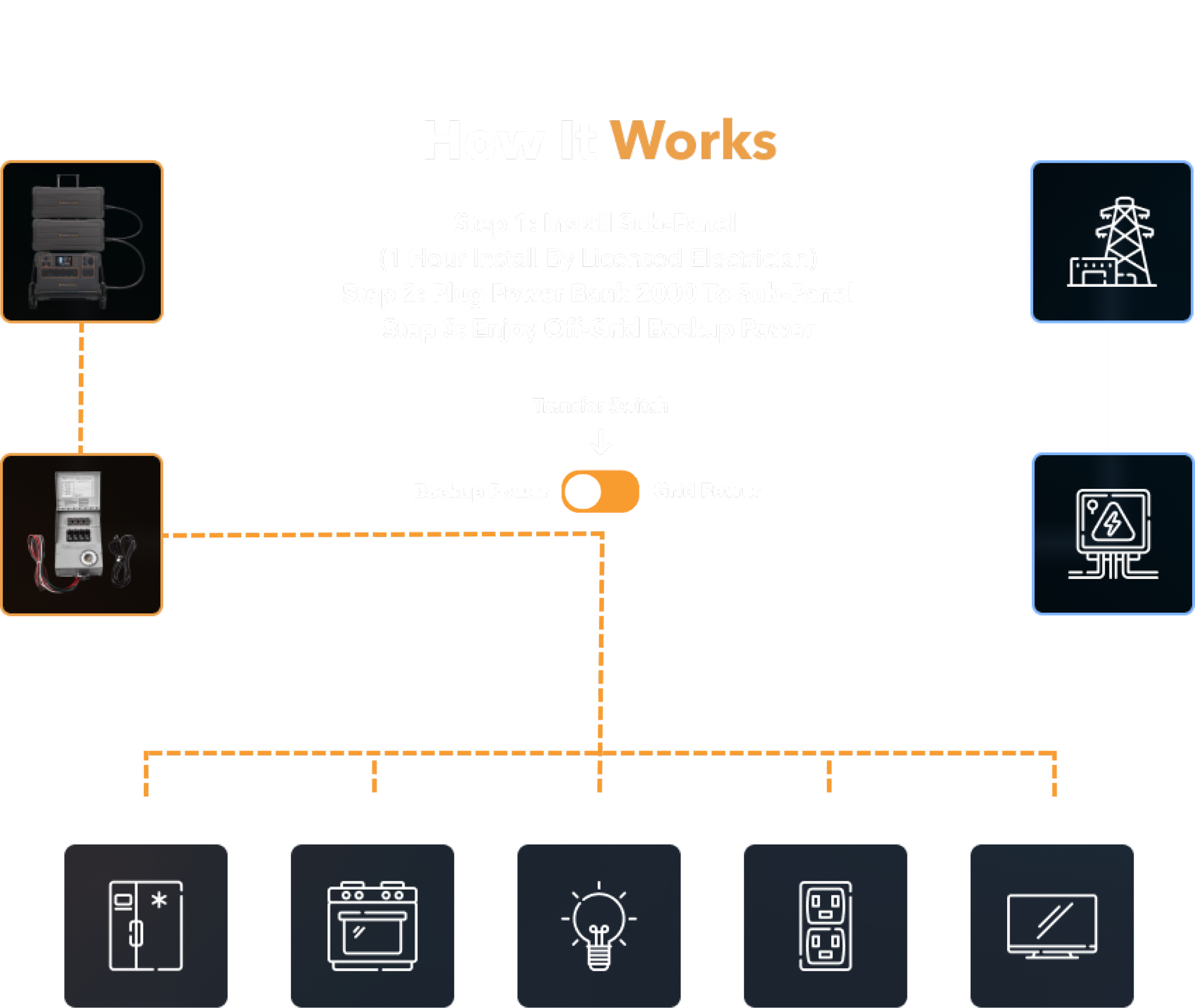

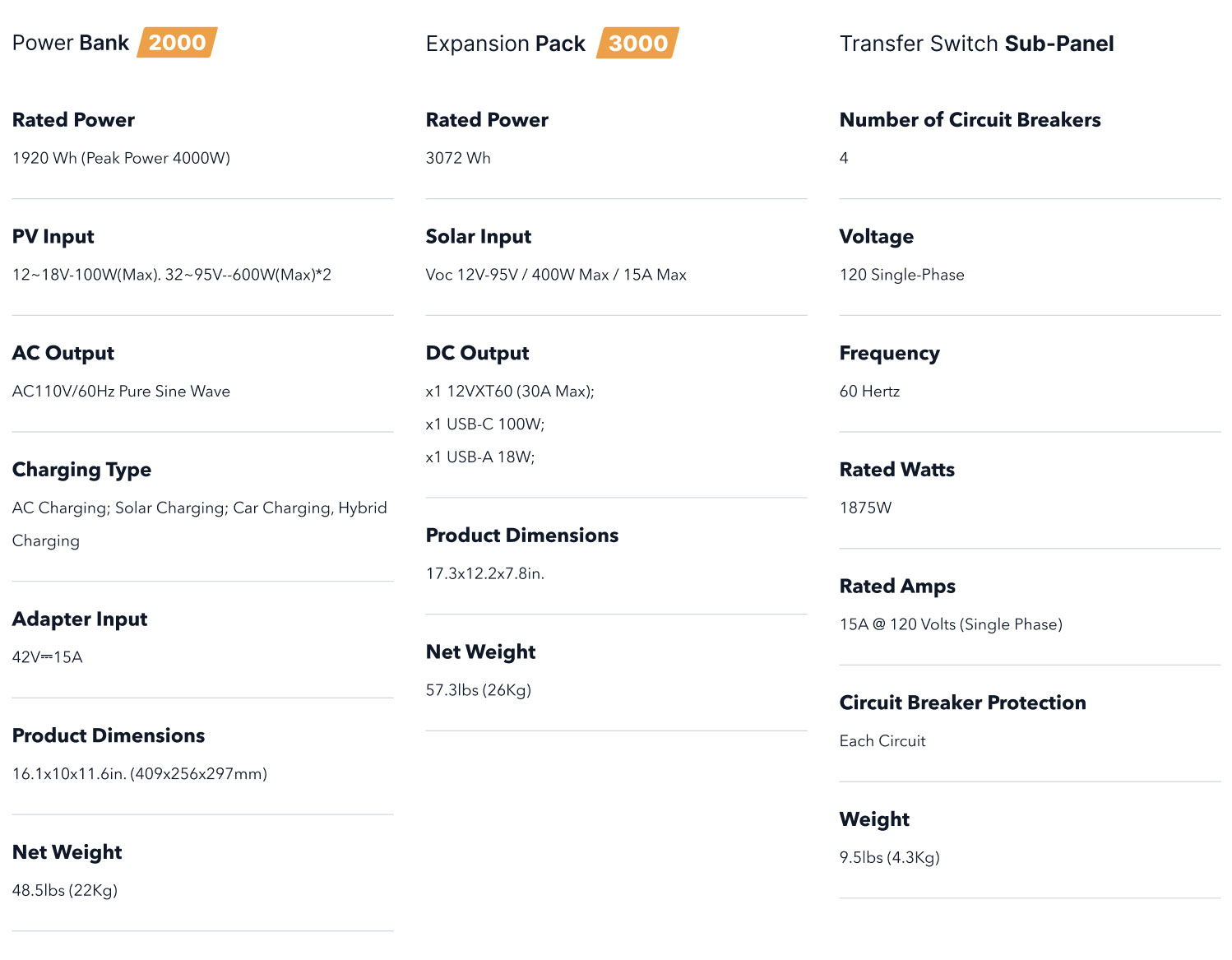

Our solution to this is the Expanded Home Backup Kit+. This kit includes a Transfer Switch Sub-Panel that is installed in tandem with your home’s electrical system, which can provide backup for 4 circuits. Without at least one Expansion Pack, the Power Bank 2000 does not meet the minimum capacity requirements outlined above.